Wed 20 Nov. 2019

Insuring Women's Futures - Day 3

This week is National Money Week, and your local Institute are further supporting the CII's campaign "Insuring Women's Futures".

We will be releasing blogs on the website related to the six key points in a woman's life that are financially important, as well as the potential pitfalls women may face.

All the information contained in these articles and more, is taken from the dedicated website - insuringwomensfutures.co.uk

5. Later life, planning and entering retirement

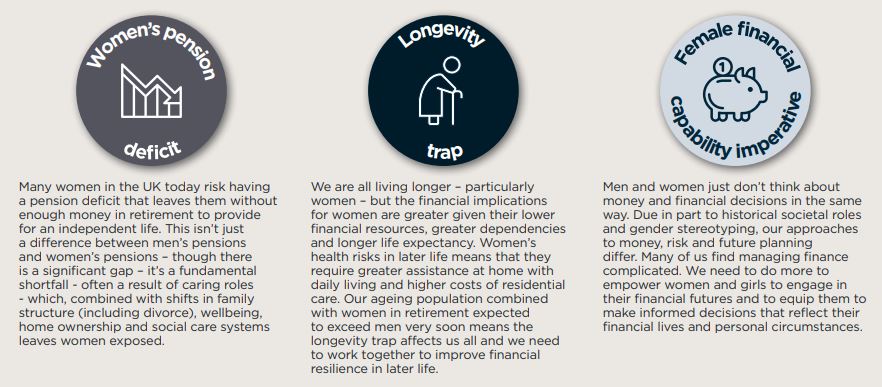

We all hope to live long and fulfilling lives. Planning for later life starts early. With women having children later, caring for and living longer, spending more time as retirees, retirement planning through life and in the run up to retirement is key, especially as many of us are likely to have to contribute to the cost of end-of-life care.

Think about how you’d like to live in retirement and investigate how much you’ll need to set aside.

If you are an employee, check out your employer’s pension arrangements, free employer contributions and tax deductions, and fully consider joining the pension scheme. If there are options on how much to contribute, you might be surprised how much bigger your pension pot could be if you paid in at a higher rate, together with the added ‘free employer and tax relief money’. Go on, find out!

Be aware of differences in your and your partner’s pension pots and consider what that means for later life planning and pension drawdown at retirement. This is the Moment to really consider all of your financial assets (and your partner’s, if you have one). For example, how much your assets will be worth, depending on when you retire and how to apply these in retirement, and considering if you might need care. It’s vitally important to take these decisions together and to understand the potential consequences of one of you living longer.